Effective Ways to Transfer Cash App to Bank in 2025

Transferring funds from Cash App to your bank is straightforward, yet many users still have questions about the process. In this guide, we’ll explore the simple steps for moving money from Cash App to bank accounts effectively in 2025. Whether you’re using **Cash App for personal transactions or managing business finances**, understanding how to complete a **Cash App bank transfer** efficiently is crucial. Let’s delve into the methods available to ensure you easily navigate the **Cash App transfer process**.

Understanding Cash App Transfers

The **Cash App transfer process** is designed to make it easy for users to send and receive money. This section will break down the types of transfers you can utilize on Cash App while providing clarity on how you can **link Cash App to bank** accounts for easier transactions.

Types of Cash App Transfers

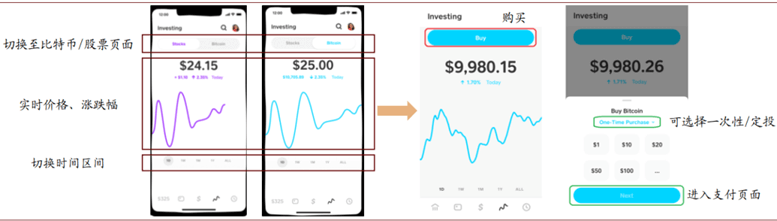

Cash App offers various options for money transfer, including sending money to other users and transferring your funds to a bank. Users can initiate a **Cash App bank transfer** by simply selecting their desired amount and entering their bank details. Additionally, you can decide to make a **Cash App direct deposit**, allowing funds from your paycheck or other income sources to be directly deposited into your Cash App. Understanding these options can enhance your **Cash App money management** skills and streamline your transactions.

How to Link Cash App to Bank

Linking your bank account with Cash App is vital for making cash withdrawals seamless. To do this, go to your Cash App settings and select ‘Banking.’ From there, you can enter your bank account and routing number to complete the connection. Once linked, you’ll be able to quickly initiate a **cash app send money to bank** process or receive direct deposits. Remember to ensure your **Cash App bank name** details are accurate to avoid transfer issues.

Cash App Withdrawal Process

To withdraw money from your **Cash App balance**, simply navigate to the ‘Cash’ tab and click on ‘Withdrawal.’ You’ll then be prompted to select your linked bank account for transferring your funds. After confirming the withdrawal, a **Cash App transfer confirmation** notification will appear, indicating that your funds are on their way to your bank. Ensure you understand **Cash App transfer limits** to avoid complications during the withdrawal process.

Steps to Transfer Cash App Funds to Bank

Here’s a thorough guide on how to effectively transfer cash from Cash App to your bank account. By following these steps, you can manage your finances more easily and ensure you are using Cash App to its fullest potential.

Step-by-Step Guide to Transfer Funds

1. **Open Cash App:** Begin by launching the Cash App on your mobile device.

2. **Select ‘Cash’ or ‘Profile’:** Tap on the icon representing your cash balance or your profile settings.

3. **Choose ‘Withdraw’:** Look for the withdrawal option and select your preferred withdrawal method. Typically, this involves selecting your linked bank account.

4. **Enter Amount:** Specify how much you want to transfer.

5. **Confirm Transfer:** Carefully review the information and tap ‘Confirm’ to initiate the transfer. Keep an eye on your **Cash App transaction history** for any updates.

By following these simple steps, you will be able to complete your **Cash App to bank withdrawal** in no time. Always ensure your app is updated to the latest version for an optimal experience.

Cash App Transfer Fees

While many Cash App transactions are free, be aware that some transfers may incur fees. When using a debit card for expedited transfers, a small percentage might be deducted. It’s important to review the **Cash App bank transfer fees** and understand any charges associated with your transactions. If you’re using Cash App frequently, being mindful of these fees can help maintain your financial health.

Common Issues and Troubleshooting

Encountering problems with your **Cash App transfer** can be frustrating. Some users report issues such as transactions failing or funds not appearing in their bank accounts. If you face these problems, consider checking the connection with your bank and ensuring your **Cash App bank account setup** is correct. If issues persist, don’t hesitate to reach out to **Cash App customer support** for assistance.

Ensuring Security with Cash App

In today’s digital age, protecting your financial information while using apps like Cash App is essential. In this section, we’ll cover security practices that enhance your experience and safeguard your transactions.

Security Features of Cash App

Cash App includes various security features to help protect your funds and personal information. These features include two-factor authentication, where users receive an authentication code via phone to confirm actions like linking accounts or making transfers. Understanding these security measures is crucial for anyone concerned about **Cash App safety tips** and how to maintain a secure account.

Protecting Your Cash App Account

To enhance your security while using Cash App, regularly update your password and only use the app in secure networks. Be cautious of phishing scams and don’t share your **Cash App routing number** or details with unauthorized individuals. Protecting your account is not only about securing your **Cash App balance**, but also about ensuring that your personal data remains confidential.

Cash App Updates for Enhanced Security

Keep an eye out for updates related to Cash App features and security enhancements. Cash App regularly updates its security protocols, giving users new ways to protect against fraud. Checking the **Cash App update** section will keep you informed and ensure the smooth operation of your transactions.

Conclusion

In conclusion, mastering the **Cash App bank transfer** procedures is paramount for effective money management. By understanding the processes involved in transferring cash from Cash App to your bank, utilizing security features, and staying aware of potential fees, you gain control of your financial transactions. Whether it’s sending money or managing your accounts, knowing your options empowers your cash flow throughout 2025 and beyond. Embrace the benefits of mobile finance management with Cash App and enhance your banking experience.

Key Takeaways

- Link your bank account for seamless transactions with Cash App.

- Understand the cash withdrawal process to easily transfer funds.

- Stay informed about transfer fees and utilize Cash App’s security features.

- Contact Cash App customer support for any issues you encounter.

FAQ

1. Can I send money from Cash App to any bank?

Yes, Cash App allows users to send money to any bank, as long as you link the correct bank account and ensure that your transaction details are accurate.

2. What should I do if my Cash App transfer fails?

If a transfer fails, check your internet connection, verify the bank account link, and consult the Cash App support center for troubleshooting steps.

3. Are there any fees associated with cash transfer to bank?

Yes, although most transfers are free, expedited transfers using a debit card may incur a small fee. Always check the fees before proceeding with your transaction.

4. How do I verify my Cash App account?

To verify your account, provide necessary information including your full name, date of birth, and the last four digits of your social security number if prompted.

5. What to do if my Cash App account is blocked?

If your Cash App account is blocked, contact Cash App customer support to sort out any issues and reinstate your account access.