How to Effectively Add Tax to a Price for Complete Transparency in 2025

Understanding how to add tax to a price is essential for businesses seeking transparency and compliance with tax regulations. In this article, we will explore various methods including **tax calculation methods**, the difference between **tax inclusive pricing** and **tax exclusive pricing**, and how businesses can implement strategies such as **price adjustments for tax** that promote clear communication with consumers. By the end, you’ll have practical tips and actionable steps on calculating sales tax accurately, ensuring effective tax compliance and improving customer trust.

Understanding Sales Tax and Its Implications

Before diving into the techniques for adding tax to a price, it’s crucial to understand the various aspects of **sales tax**. Sales tax is essentially a consumption tax imposed by the government on the sale of goods and services. Each state has its own tax rate, which can complicate matters for businesses with operations in multiple regions. Businesses must grasp the concept of **price before tax** and **price after tax** as they relate to the purchasing process. Knowing how to do a **gross price calculation** and **net price calculation** can be beneficial for both sellers and consumers.

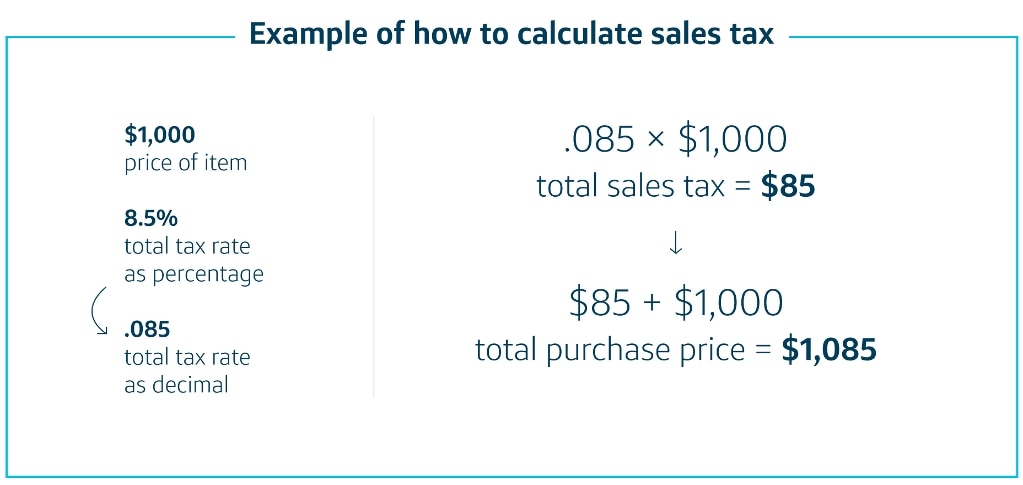

Calculating Tax on Price

One effective method for calculating tax is through the **tax calculation formula**. To determine the total price including tax, you can use the formula: Total Price = Price Before Tax + (Price Before Tax * Tax Rate). For example, if a product’s price is $100 and the tax rate is 7%, the calculation would be as follows: Total Price = $100 + ($100 * 0.07) = $107. This clarity enables consumers to understand how much tax they are actually paying, and it helps businesses in maintaining compliance.

State Tax Implications

Understanding **state tax implications** is another critical part of effectively adding tax to pricing. Each state has different sales tax rates which can affect pricing strategies. Tracking different rates is essential, especially for businesses that sell across state lines. Using an automated tool or a **sales tax calculator** can help businesses evaluate the tax impact accurately based on customer location. Companies must also be aware of any **tax exemptions** and **tax compliance requirements** relevant to their specific products and services.

Tax Breakdown for Products

Implementing a clear **tax breakdown for products** can significantly enhance customer transparency. Businesses can choose to show tax as a separate line item at checkout to ensure customers understand how tax affects the final price. This visibility increases consumer confidence and can improve sales. For online purchases, an itemized price presentation making it clear how the **tax impacts pricing** allows the customer to comprehend the share of tax attributable to their purchase.

Pricing Strategies with Tax Considerations

In developing effective pricing strategies, being mindful of the **impact of taxes on pricing** is crucial. Different strategies can ensure compliance while engaging customers and driving sales. For example, **price settings with tax** can strategically include tax in the initial listing price or specifically delineate it for greater clarity. This section discusses how to approach pricing with a **tax-inclusive pricing** versus a **tax-exclusive pricing** strategy, recognizing the implications each carries for profitability and customer satisfaction.

Effective Methods to Add Tax

One approach for **adding sales tax** smoothly is implementing fixed prices for consumers that include all taxes and fees upfront, creating a simple, predictable customer experience. If you sell products for $100 and the sales tax is 7%, instead of presenting the item for $100 and adding tax later, state the price as $107 directly. This prepares customers psychologically for the cost and establishes trust. Additionally, providing comprehensive **guidelines for tax pricing** can help consolidate customer expectations regarding total costs.

Pricing Models That Include Tax

Utilizing different pricing models that incorporate tax effectively can facilitate smarter business choices. **Pricing techniques involving tax** can help you decide whether to absorb the tax into your margin or pass it on transparently to the customer. Research indicates that consumers favor retail outlets that include complete pricing upfront. These innovative models can lead your competitors in customer awareness of **sales tax** impact, offering your business enhanced transparency and a better competitive edge.

Dynamic Pricing Strategies Involving Tax Fluctuations

A dynamic approach when setting prices keeps in mind how external factors, such as changing tax rates, can influence sales. For example, developing systematic approaches to **manage tax-related price modifications** can prevent confusion during promotions or tax changes. Keeping alerts for tax adjustments and maintaining flexibility in your church guidelines can allow your business to adapt without losing customer satisfaction or accountability.

Ensuring Tax Compliance for Businesses

Tax compliance is a crucial duty for any business. Failure to manage this responsibility can lead to penalties that impact financial health. Here we delve deeper into **tax responsibilities for sellers** and offer recommendations for adhering to tax structures while maintaining quality pricing strategies. Annual tax returns and local regulations may require altering how businesses communicate their pricing, but adherence strengthens reputation and trust.

Tax Documentation and Business Pricing Guidelines

Maintaining clear **tax documentation** provides a solid framework for compliance. Businesses should consistently track sales tax associated with products both for bookkeeping purposes and regulatory reporting. Develop a pricing calendar to remind your team of tax dates that may impact **pricing with VAT** systems or state tax changes. By adhering to clear **business pricing guidelines** while keeping detailed documentation, any questions regarding **tax in pricing strategy** can be easily addressed.

Tax Communication in Pricing

Clear communication about tax-related costs is vital. Customers appreciate transparency, so creating segments within marketing communications demonstrating how your prices incorporate tax can prevent misunderstandings. By discussing the **association of price with tax** in FAQs, email campaigns, and even at checkout stages, businesses can clarify the breakdown and build trust with their clientele, enhancing overall customer relationships.

Enhancing Pricing Through Tax Awareness

Educating consumers on the implications of tax helps in managing customer expectations regarding their purchases. Ensuring your marketing strategy capitalizes on enhancing **consumer awareness on tax** could foster loyalty as customers feel informed throughout their purchasing journey. Share relevant resources about **sales tax regulations** and changes to emphasize commitment to transparent pricing.

Key Takeaways

- Understanding the difference between tax-inclusive and tax-exclusive pricing strategies is essential for effective selling.

- Utilizing tax calculation formulas ensures clarity and compliance.

- Maintain thorough tax documentation and communication methods to improve pricing transparency.

- Dynamic pricing strategies can adequately prepare businesses for tax fluctuations.

- Educating consumers on tax impacts builds trust and reinforces brand loyalty.

FAQ

1. What is the difference between tax-inclusive and tax-exclusive pricing?

Tax-inclusive pricing means that the price shown already includes tax, whereas tax-exclusive pricing shows the price before tax, and tax is added at checkout. Understanding this difference is crucial for proper pricing strategies and transparency.

2. How do I determine the effective tax rate for goods?

To find the effective tax rate, divide the total tax collected by the total sales for a specific period. This percentage reflects the average tax burden on your goods and services, which can differ significantly based on your product types and local regulations.

3. What is the importance of detailed tax documentation?

Comprehensive tax documentation enables businesses to comply with legal regulations, provides clear records for audits, and ensures easy calculations of sales tax obligations. With accurate documentation, businesses can avoid penalties and maintain a trustworthy reputation.

4. How can I effectively communicate tax breakdowns to customers?

Utilize clear communication strategies such as itemized bills that separately present tax costs, create FAQs addressing common inquiries about pricing and tax, and provide educational content online to explain tax implications transparently to customers.

5. Are there tools for automating tax calculations online?

Yes, there are various tools available such as sales tax calculators and accounting software that can automate tax computations, ensuring accurate and efficient assessment of tax obligations for businesses, particularly those operating in multiple states.

By applying the methods outlined above, businesses can foster greater transparency and compliance concerning sales tax, ultimately improving customer relationships and maintaining operational integrity in pricing.