“`html

Effective Ways to Find Growth Rate

Understanding Growth Rate: Definition and Importance

The **growth rate** is a fundamental metric that measures how quickly a particular variable expands over time. This could apply to **business growth rate**, population, or economic conditions. Understanding the **growth rate definition** is essential for stakeholders in any industry, as it informs decisions related to investments, resource allocation, and strategic planning. Whether you’re assessing **economic growth rate** for a country, or measuring **revenue growth rate** in a business, mastering the growth rate formula can offer profound insights into future trends and performance.

What is Growth Rate?

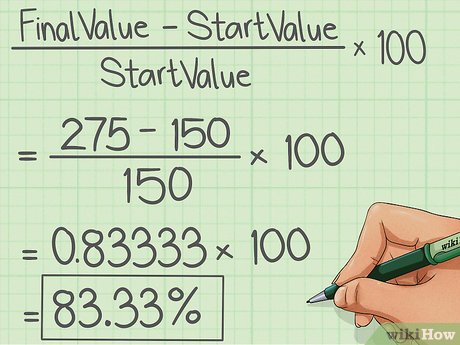

The **growth rate** can be represented in various forms, such as **population growth rate** or **business growth rate**. It indicates the percentage increase in a specific variable over a designated period. For example, if a company’s revenue increases from $100,000 to $120,000 in one year, the growth rate can be calculated using the growth rate formula: ((New Value – Old Value) / Old Value) * 100. This highlights a **percentage growth rate** of 20%. Understanding how to calculate growth rates effectively helps in analyzing the health of economies or individual businesses.

Importance of Growth Rates in Business

Measuring **growth rates** is critical in business practices because it enables organizations to assess performance and set realistic objectives. By evaluating key performance indicators and respective **growth metrics**, businesses can strategize their efforts towards market penetration or expansion, ensuring sustainability and profitability in the long run. Forecasting expected **growth projections** becomes easier when businesses know how to determine growth rates accurately.

Methods to Calculate Growth Rate

There are several methodologies to **calculate growth rate** effectively, which vary based on the application and time frame under consideration. Most commonly, businesses and economists might use either **compound growth rate** or **annual growth rate** practices to analyze results over different periods, making the evaluation more comprehensive and actionable.

Compound Growth Rate

The **compound growth rate** is a method used to find the growth rate over multiple periods, assuming that the growth builds on the previous period’s growth. It is often represented as:

CGI = (Ending Value / Beginning Value) ^ (1 / Number of Periods) – 1

For instance, if a company grows from $100,000 to $150,000 over three years, determining the **compound growth rate** would provide an average annual growth rate for better strategic projections. Understanding this method allows businesses to plan resources more effectively.

Annual Growth Rate: Year-Over-Year Measurements

The **annual growth rate** is a straightforward formula that determines the growth of a value each year. By updating financial forecasts and monitoring KPI’s against last year’s numbers, businesses can utilize this growth metric to identify trends and biases. For example, investors typically analyze **annual growth rate** to decide if a particular stock has the potential for future growth. Knowing how to report growth rates correctly can assist stakeholders in making informed decisions about their investments and strategic direction.

Analyzing and Interpreting Growth Rates

Analyzing **growth rates** goes beyond just calculations; it involves interpreting the implications and trends exhibited by the results. Understanding historical data on growth rates, alongside current **growth metrics**, aids stakeholders in recognizing dormant trends or opportunities for expansion.

Growth Rate Analysis Techniques

Employing robust **growth rate analysis** techniques can dramatically illuminate the operational dynamics within a business or sector. Strengthening one’s grasp over these practices includes comparing the **growth rates** of parallel companies or industries, allowing stakeholders to gauge where they stand relative to competitors. Utilizing comparative analysis helps businesses reveal underlying strengths and weaknesses. Furthermore, monitoring historical growth rates reveals patterns that can signal future opportunities or potential drawbacks in the market.

Growth Factors: What Drives Growth?

Identifying the critical **growth factors** driving the fluctuations in growth rates is pivotal for businesses aiming to harness opportunities proactively. Factors such as demand, technology advancement, market trends, customer preferences, and demographic changes profoundly affect growth dynamics. Regular assessment of these influencing factors enables teams to adapt strategies and forecast necessary adjustments that could enhance overall performance metrics and ultimately lead to sustainable growth.

Evaluating Growth Rate Accuracy and Future Projections

Looking ahead, businesses must focus on accurate **growth rate evaluations** to make informed decisions regarding future strategies. Reliable measurement can not only improve operational effectiveness but also assist in adjusting expectations based on up-to-date economic environments and market conditions.

Growth Rate Dynamics in Various Industries

The dynamics of growth rates vary widely across different sectors. For instance, the technology industry often experiences high **market growth rates**, while more mature industries like agriculture may contend with slower annual growth strategies. Understanding these differences is crucial for strategists to tailor investments and approaches accordingly, facilitating more adaptable business planning.

Forecasting Future Growth Rate Trends

When project management considers imminent economic forecasts, integrating **forecast growth rates** becomes a decisive tool. Businesses frequently employ data trends and predictive modeling to provide insights into potential market expansions and contractions. This method not only supports key decision-making but can also highlight unforeseen growth opportunities based on **growth rate projections**, enhancing the organization’s agility in navigating the business environment.

Key Takeaways

- Understanding and accurately measuring growth rate is crucial for investment and strategic planning.

- Different methodologies for calculating growth rates, such as compound and annual growth rates, facilitate comprehensive analyses and projections.

- Knowledge of growth factors and effective analysis techniques informs businesses on their growth trajectory and necessary adjustments.

- Forecasting future growth effectively helps organizations prepare effectively for market changes.

FAQ

1. What is the significance of growth rate in finance?

The **growth rate in finance** is crucial for evaluating the performance of investments. Investors gauge the health of their assets by analyzing both current and historical growth rates, allowing them to make informed decisions about future investments. The implications of fluctuating growth rates can significantly affect stock values and financial security.

2. How do you calculate annual growth rate accurately?

To calculate the **annual growth rate**, you’ll need to gather the starting and ending values over the period. You can use the formula: ((Ending Value – Starting Value) / Starting Value) * 100 to derive the percentage growth over just one fiscal year. This metric helps gauge incremental progress towards overall objectives.

3. Can you explain growth rate dynamics in different sectors?

Yes, the **growth rate dynamics** differ significantly between sectors due to varying factors such as market demand and technological advancements. For example, tech industries often show high growth due to constant innovation, while environmental sectors may have slow but steady growth due to regulatory impacts.

4. What are some common growth rate indicators?

Common **growth rate indicators** include GDP growth rates, revenue growth rates in companies, and employment growth rates. These amount to important measurements reflecting broader economic health or company performance, allowing stakeholders to make informed decisions based upon these placements.

5. How can I analyze growth rates effectively?

To analyze **growth rates effectively**, employing various data collection methods such as surveys or historical data review allows for a nuanced understanding of growth trends. Additionally, comparative analysis against competitors can reveal performance strengths and weaknesses unique to the business’s context.

“`