“`html

Effective Ways to Remove Paid Collections from Your Credit Report in 2025

As financial responsibility becomes vital in today’s world, understanding how to remove paid collections from your credit report is crucial. Paid collections, while less harmful than unpaid debts, still have an adverse effect on your credit score. This comprehensive guide unveils effective strategies for deleting paid collections, ensuring that they don’t hinder your financial well-being. We will discuss practical credit repair tips, important consumer rights, and the credit dispute process to enhance your credit profile and assist in credit report cleanup.

Understanding Paid Collections and Their Impact

Before diving into how to remove paid collections, it’s essential to understand their effect on your credit score. Paid collections may appear as negative items on your credit report, impacting lenders’ perceptions of your financial responsibility. Each time a collection agency reports a collection account, it can lower your score, potentially affecting loan approval rates or interest rates. Moreover, management of these negative impacts determines your financial future, with paid collections lingering in your report for several years. By improving your credit score, you’re not only enhancing your credit profile but also opening doors to better financial opportunities.

How collections affect your credit score

The impact of collections on credit scoring is significant. When a collection account is reported, it reflects negatively on your payment history, accounting for a large portion of your credit score calculation. This may cause your score to drop substantially. However, it’s important to note that paid collections have less weight than unresolved debts. By focusing on removing these negative entries and disputing inaccuracies, you can improve your overall credit standing. Engaging in practices such as obtaining your free credit report regularly and monitoring credit report accuracy is pivotal for quick detection of any issues.

Legal Rights with Collections

Being aware of your legal rights in dealing with collection agencies is incredibly important. Consumer Protection Laws, particularly the Fair Debt Collection Practices Act (FDCPA), protect you from unfair practices. Under these laws, you can challenge a collection agency’s actions and verify the legitimacy of old debts. If an agency violates your rights, you may report them and even seek legal action. Knowing these rights not only empowers you in challenging collection accounts but also provides peace of mind while you navigate your credit repair journey.

Collecting Accurate Credit Information

Another essential aspect of managing collections on your credit report is ensuring that the data being reported is accurate. Any inaccuracies can lead to significant score reductions and wrongful assumptions about your financial status. If you suspect errors in your credit report, you can initiate a credit report dispute process to correct these inaccuracies. This involves gathering evidence and providing any necessary documentation to demonstrate discrepancies. Agencies have a legal obligation to investigate your claims under the Fair Credit Reporting Act (FCRA). Maintaining correct credit information not only aids in improving your credit score but also boosts the credibility of your credit profile.

Strategies for Deleting Paid Collections

Removing paid collections from your credit report is a crucial step towards cleaner credit history. Various strategies can be applied to effectively challenge these entries, ranging from negotiating with creditors to establishing a pay-for-delete agreement. This section elaborates on different methods to approach collection accounts with the intent to remove them, thus enhancing your credit score.

Negotiating with Creditors

One effective strategy for negotiating with creditors is proposing a debt settlement. This involves offering a lump-sum payment that is less than what you owe in exchange for the removal of the paid collection from your credit report. A successful negotiation often requires documentation of the agreement and follow-through to ensure the reporting agency updates your status. Many individuals find that establishing a personal connection with creditors can lead to more favorable outcomes. Remember to remain firm yet polite during these negotiations, as professional communication can yield better results.

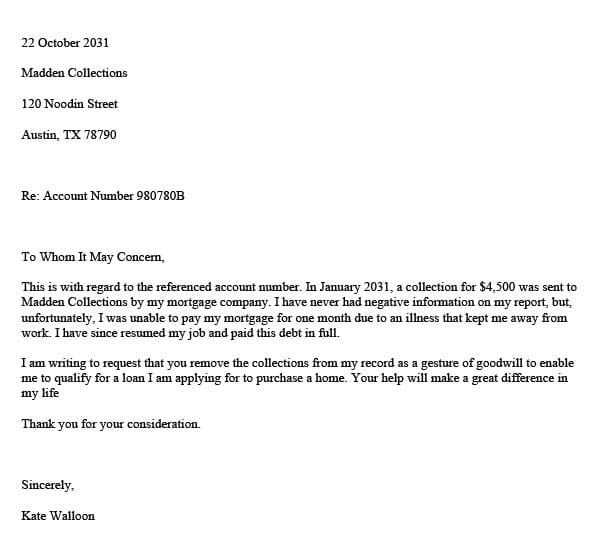

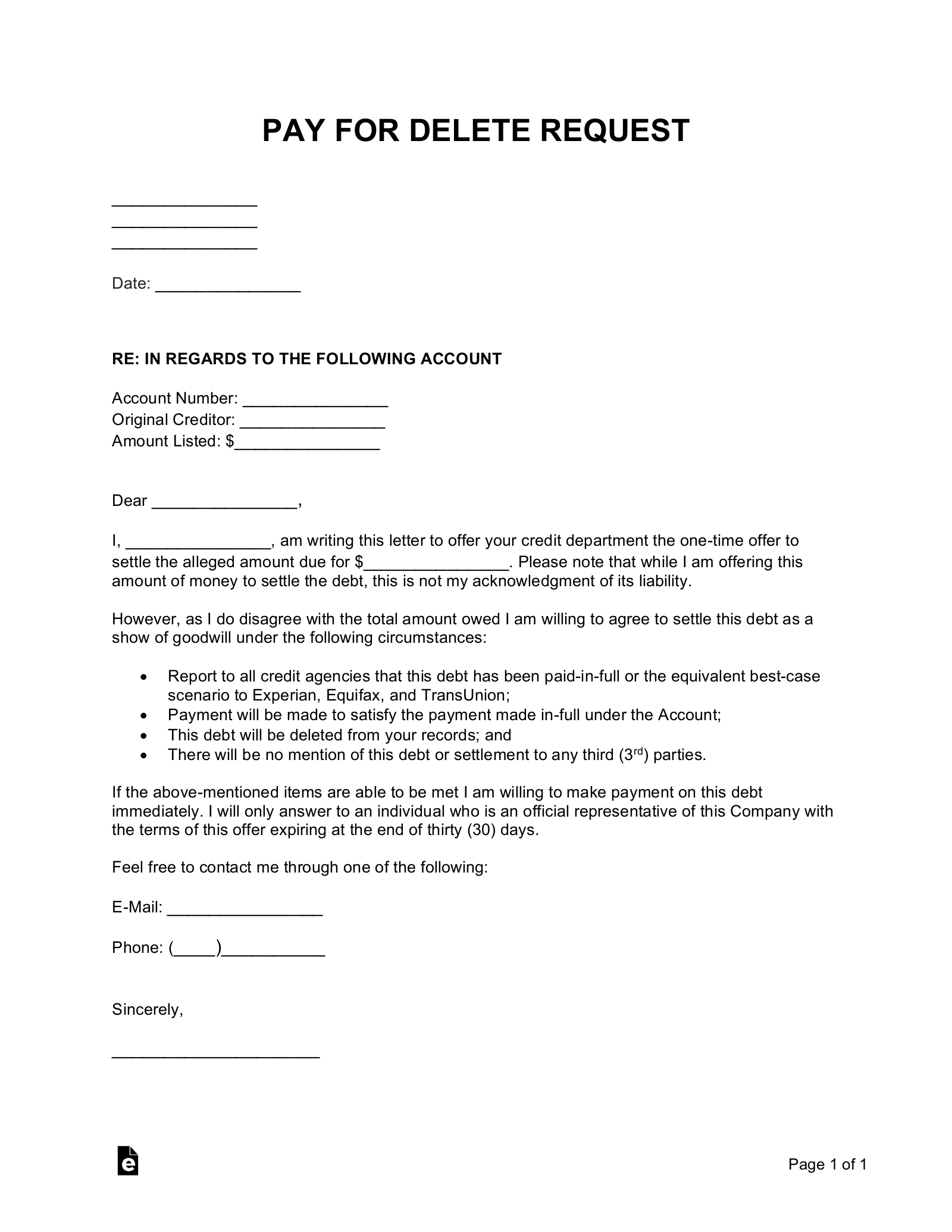

Pay-for-Delete Agreements

Another powerful tool in the quest for clean credit is the “pay-for-delete” agreement. Upon settling a debt, you may request the creditor to remove any associated collection entry from your report. This written agreement is crucial as it outlines the terms of this transaction. Not all creditors will agree to this strategy, but many are willing to consider it, especially if they’re inclined to resolve outstanding debts. Establishing a successful pay-for-delete agreement can significantly boost your credit score and contribute to a clean credit history.

Debt Validation Requests

If your account is listed by a collection agency and you’re unsure about its validity, demanding a debt validation request is a smart move. Requesting this validation necessitates that the agency proves their right to collect the debt. If they fail to do so, you can legally request that the collection entry be removed from your credit report. Make sure to document all communications and keep copies of your request as well as their subsequent responses. This proactive approach not only enhances your understanding of collection agency practices but also protects your consumer rights.

Credit Report Cleanup and Improvement Tips

Once you’ve established strategies for removing paid collections, it’s vital to engage in regular credit report cleanup activities. Alongside efforts to delete negative items, certain tips can further improve your credit score and financial standing overall.

Regular Monitoring of Credit Reports

Monitoring your credit report consistently allows you to stay informed on changes or inaccuracies in your credit data. Utilizing a credit reporting service can simplify this process. Regular checks can help facilitate fast credit report disputes when errors are spotted. Additionally, these services may offer recommendations on managing debt and improving your overall credit profile. Staying on top of your credit gives you a proactive approach to your financial health.

Understanding Your Credit Score

Another vital component of credit repair is understanding what influences your credit score. Key factors include payment history, credit utilization, and types of accounts in use. Educating yourself regarding these aspects can empower you to make better financial decisions and understand why collections and negative items are decreasing your score. The significance of timely payments cannot be overstated; late payments can substantially impact your credit ratings, harming your chances for favorable credit terms.

Long-Term Financial Strategies

In the long term, ensuring you maintain good credit practices can greatly aid your recovery from collections. Strategies can include budgeting efficiently, avoiding unnecessary debt, and negotiating with creditors transparently. Engaging with credit counseling services can also bolster your recovery journey; these professionals can guide you in managing your debt load and building a more robust financial foundation.

Key Takeaways

- Understanding paid collections’ impact is crucial for effective credit report management.

- Negotiating with creditors and establishing pay-for-delete agreements can aid in removing negative items.

- Stay proactive regarding credit report cleanup through regular monitoring and understanding your credit score components.

- Utilizing your consumer rights can provide additional leverage when dealing with collection agencies.

- Long-term financial strategies complement credit repair efforts for a healthier credit future.

FAQ

1. How do I check my credit report for paid collections?

You can obtain a free credit report from multiple sources, including annualcreditreport.com. Reviewing your credit report regularly allows you to identify any paid collections and disputes before they impact your score.

2. What should I do if a collection agency is harassing me?

Under consumer protection laws, you have rights. You can file a complaint against the collector for any unfair practices. Consider seeking legal advice if harassment continues, ensuring you take informed steps in managing collections.

3. How effective are credit repair agencies in removing paid collections?

Many credit repair agencies operate under the premise of challenging inaccuracies and negotiating with creditors on your behalf. It’s essential to choose reputable services for the best results in credit report cleanup.

4. Can I remove a paid collection on my own?

Yes, individuals can remove paid collections through various strategies discussed, such as disputing inaccuracies, negotiating debt settlements, or formally requesting validation of debts with the collection agency.

5. How long do paid collections stay on my credit report?

Paid collections typically remain on your credit report for up to seven years from the date of your initial missed payment; however, they may have a reduced impact as time passes. Engaging in credit repair strategies can help mitigate their effects.

“`