How to Properly Buy Nvidia Stock and Maximize Your Investment in 2025

Nvidia has captured the attention of investors seeking to capitalize on the booming tech sector. As one of the leading companies in graphics processing units (GPUs), understanding how to buy Nvidia stock effectively can be crucial in maximizing your investment potential. This article presents practical steps and considerations on how to invest in Nvidia, focusing on strategies for purchasing Nvidia shares, analyzing market trends, and identifying the best timing for investments.

Nvidia Stock Overview

Before diving into how to invest in Nvidia, it’s essential to grasp an overview of Nvidia Corp, its role in the semiconductor industry, and the factors driving its stock price. Nvidia has consistently demonstrated strong revenue growth and innovation in technology, positioning itself as a leader in AI, gaming, and automotive sectors. By understanding Nvidia’s market position and future forecasts, investors can make informed decisions about their stock purchases.

Understanding Nvidia Stocks

Nvidia stocks represent ownership in a company that has become synonymous with cutting-edge technology, particularly in GPU manufacturing. Their products cater to diverse markets, from gaming and data centers to AI applications and autonomous driving. When looking to **buy Nvidia stock**, be sure to analyze factors affecting Nvidia stocks, including earnings reports, technological advancements, and competition in the semiconductor sector. Investors should consider Nvidia’s market capitalization as a signal of its overall size and growth potential within the tech industry.

Nvidia Stock Price Trends

Analyzing *Nvidia stock price* trends over the years can provide insights into its historical performance and reassure investors about future investments. Investors should study charts showing past price movements, including periods of significant growth and potential retracements. Tracking Nvidia stock performance helps determine entry points for purchasing shares and can give a clear idea of price volatility and the best time to buy Nvidia in the market.

Nvidia Stock Growth Potential

Nvidia’s growth potential is heavily tied to its technological innovations and expanding industry applications. The rise of artificial intelligence and an increase in data center requirements are set to further boost Nvidia’s revenues. Investors should keep an eye on upcoming product launches, earnings reports, and partnerships that could positively impact Nvidia stock growth. Evaluating these aspects can help project Nvidia’s stock future predictions and guide investment strategies.

Strategizing Your Investment

Crafting a strategy for investing in Nvidia shares is vital for maximizing returns. Different approaches to investing can yield varying effects on profitability, depending on market conditions and individual investor goals.

Nvidia Shares Buy Strategy

To devise a **Nvidia shares buy strategy**, consider both long-term and short-term investment horizons. For long-term investors, a buy-and-hold approach focusing on fundamental analysis could yield substantial returns as Nvidia continues to innovate and dominate its field. In contrast, for those looking for short-term opportunities, employing a trading strategy can work wonders. Keeping tabs on daily fluctuations, earnings announcements, and market news surrounding Nvidia enables investors to make precise buying decisions.

Where to Buy Nvidia Stock

Choosing the right trading platform is crucial. Most investors turn to online platforms for Nvidia shares, such as public trading apps and established brokerages. It’s important to compare **US trading platforms for Nvidia** concerning fees, ease of use, and available resources for stock analysis. When considering where to buy Nvidia stock, be sure the platform provides robust research tools to maintain awareness of **recent Nvidia stock trends** and performance metrics.

Nvidia Stock Recommendations

Seeking out professional **Nvidia stock recommendations** can bolster your investment strategy. Many financial analysts offer insights into the stock’s future predictions and fundamental analysis. Staying informed about **Nvidia stock dividends** and shareholder benefits can enhance your long-term investment outlook. Utilize online forums and expert opinions to gather diverse perspectives on Nvidia’s financial performance and strategic direction.

Analyzing Nvidia Stock Performance

To effectively invest in Nvidia, it’s crucial to conduct a comprehensive analysis of Nvidia stock performance and market conditions. Various factors can impact stock prices and investments, necessitating continuous monitoring.

Nvidia Earnings Report Insights

A vital component of analyzing **Nvidia stock performance** is staying up-to-date with Nvidia’s earnings reports. These provide insights into the company’s revenue growth and profitability, which can significantly impact **Nvidia’s stock volatility**. Post-earnings analysis can also reflect market reactions and guide decisions on whether to **invest in Nvidia Corp** or possibly consider trading options moving forward.

Assessing Market Volatility

Understanding *Nvidia stock volatility* is essential to manage investment risks properly. The tech sector is often subject to rapid changes influenced by market competition, economic shifts, and consumer demand. Familiarizing yourself with how external factors influence Nvidia’s profitability can help investors mitigate risks. Comprehending technical analysis and past stock behavior can aid in navigating potential market downturns and timely investments in Nvidia during favorable conditions.

Nvidia Competition Analysis

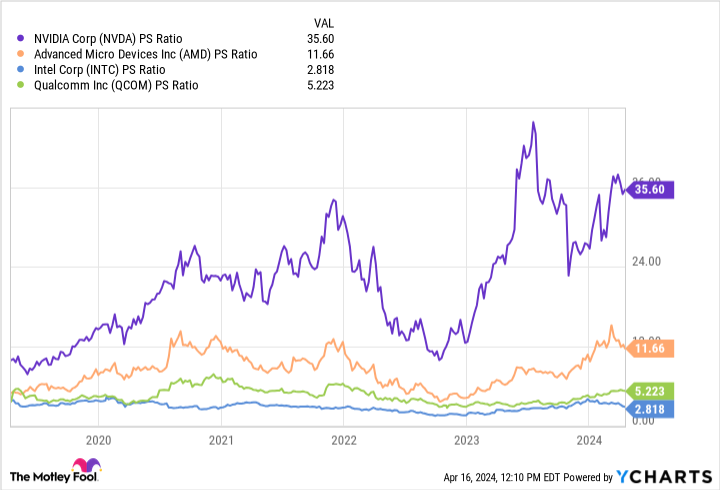

Taking a closer look at competitors like AMD can inform better investment decisions. Performing **competition analysis** allows Nvidia investors to compare how other companies in the semiconductor industry are performing and strategizing. Understanding where Nvidia stands against its competitors, alongside evaluating the potential impacts on pricing and market share, is crucial in refining your investment strategy.

Key Takeaways

- Thoroughly understand Nvidia’s market presence and growth potential before investing.

- Craft a well-defined strategy based on your investment horizon.

- Analyze Nvidia earnings reports and stock performance regularly.

- Utilize reputable trading platforms to make informed purchasing decisions.

- Monitor competition and market volatility to minimize risks and maximize investments.

FAQ

1. What is the best time to invest in Nvidia stocks?

The best time to invest in Nvidia stocks can vary, but many investors find value in researching historical trends and waiting for market dips. Utilizing key insights from earnings reports or technological advancements can also guide **the best time to buy Nvidia** shares in alignment with positive growth forecasts.

2. How to check Nvidia’s recent stock trends?

To check **recent Nvidia stock trends**, utilize stock market apps, financial news websites, or the market analysis section in brokerage platforms. Aggregate stock performance data, current news about Nvidia, and peer comparisons can provide a comprehensive view of Nvidia’s market standing.

3. Are there specific risks associated with buying Nvidia stock?

Yes, like any investments, there are risks involved with buying Nvidia stock. Factors such as market volatility, competition, and regulatory changes in the tech industry could impact Nvidia’s future profitability and stock price, making **understanding the risks of buying Nvidia stock** essential.

4. How do I evaluate the financial performance of Nvidia?

Evaluating Nvidia’s financial performance involves analyzing key metrics such as revenue growth, profit margins, and price-to-earnings ratios found in **Nvidia’s annual reports** and quarterly earnings snapshots. This data can significantly guide investment decisions based on financial health and market trends.

5. How do Nvidia stock dividends look for investors?

Currently, Nvidia does not pay dividends, but investors should watch announcements regarding any dividend policies as the company grows. Investing in growth stocks like Nvidia does focus more on capital appreciation rather than immediate **Nvidia stock dividends** for returns.

—

Conclusion

Understanding how to buy Nvidia stock wisely can help maximize your investment potential in the dynamic tech arena. By comprehensively analyzing market trends, focusing on strong growth potential, and employing strategic buying methods, investors can enhance their portfolios and capitalize on Nvidia’s success over the coming years. Be proactive in your investment journey and watch out for opportunities to optimize your Nvidia stock investments.

For further detailed reading, consider visiting How Geek or check this niche guide.