“`html

Simple Guide to How to Apply for Pell Grant in 2025

Applying for financial aid can be overwhelming, but understanding how to apply for Pell Grant in 2025 can simplify the process significantly. This essential guide will outline the steps, required documents, and key eligibility criteria for the Pell Grant application process. As a federal program, the Pell Grant provides vital funding for undergraduate students who demonstrate high financial need. Read on to discover the necessary steps to secure this important financial assistance for your college education.

Understanding Pell Grant Requirements

The **eligibility for Pell Grant** is primarily determined by your financial need, academic history, and the cost of attending your chosen school. This grant is typically available to undergraduate students who have not yet earned a bachelor’s or graduate degree, making it a vital resource for first-time college students. To qualify for the Federal Pell Grant, prospective students must meet specific eligibility criteria, which often include demonstrating significant financial need as assessed through the FAFSA.

Eligibility Criteria for Pell Grant

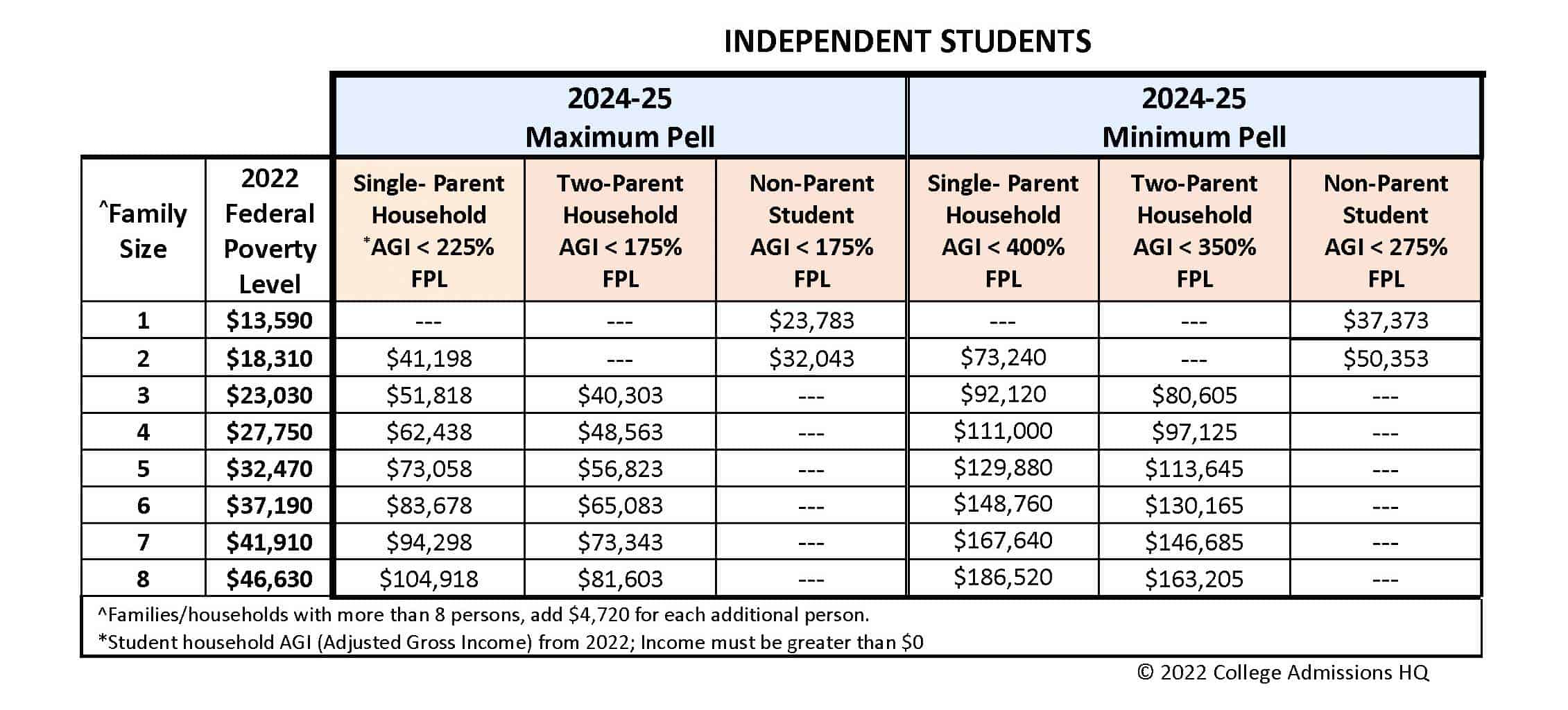

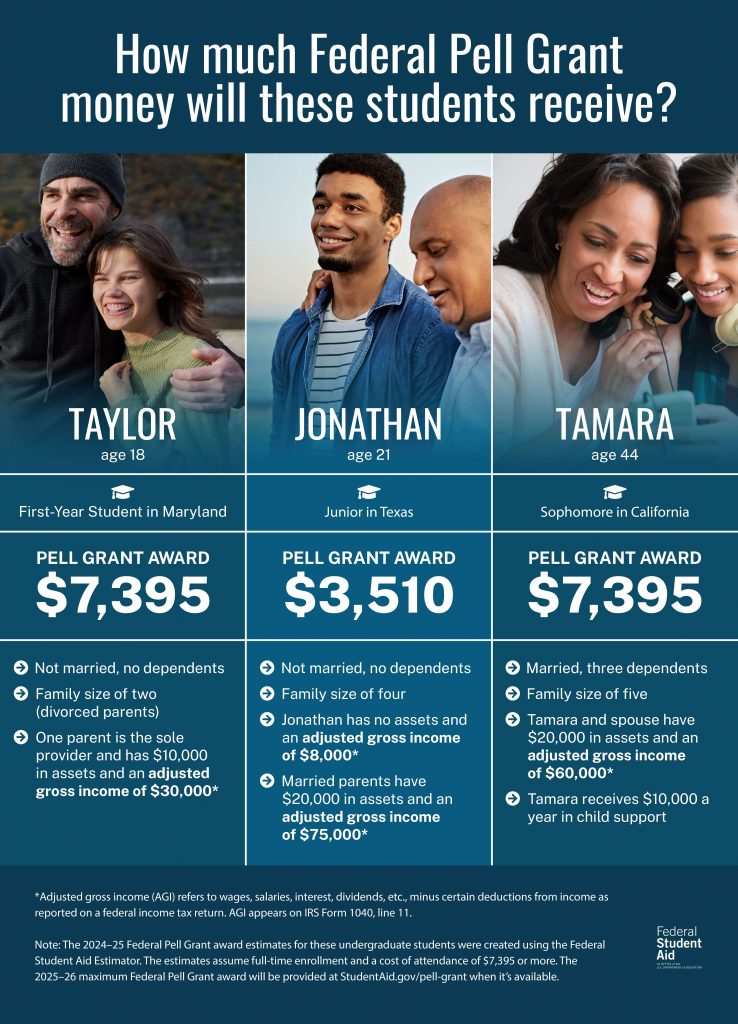

To understand if you qualify, you should first check the **Pell Grant eligibility criteria**. Factors include your Expected Family Contribution (EFC), the cost of attendance at your chosen institution, and enrollment status—whether you are attending as a full-time or part-time student. Importantly, the Pell Grant is targeted toward low-income students, so understanding the **income thresholds for Pell Grant** eligibility is crucial. Additionally, students who are incarcerated or have already completed certain degree programs may not be eligible.

Pell Grant Application Process Explained

The **Pell Grant application process** begins with completing the Free Application for Federal Student Aid (FAFSA). This online application collects financial information that will help determine your eligibility for the Pell Grant as well as other forms of federal financial aid. Ensure you gather all necessary financial documents, including tax returns, before starting the FAFSA to streamline the process. Remember to pay attention to **Pell Grant deadlines**, as submitting your application on time is critical for consideration.

Necessary Documents for Pell Grant

As you prepare to apply, it’s important to know what **application documents** are required. Necessary materials typically include your Social Security number, tax documents, income records, and details about your school. Streamlining the collection of these documents can lead to a smoother application experience and help you understand potential **Pell Grant award amounts** from the start. Ensuring all your documents are accurate and complete will also reduce the chances of delays in processing your application.

Applying for Pell Grant Online

With the rise of digital applications, applying for the Pell Grant has become more accessible through an **online application** via FAFSA. The online system enables you to not only apply for the Pell Grant but also check the status of your application effortlessly. The streamlined process allows for quick updates if your financial situation changes and automatically considers any other federal funding options you may be eligible for.

Completing the FAFSA Form

Completing the FAFSA is the first step in applying for the Pell Grant. Be sure to **fill out the FAFSA accurately** and submit it before the application deadline. The online FAFSA form requires detailed financial and demographic information that helps the federal government assess your financial need. Utilize resources available online that offer insights and tips** to successfully navigate this form, ensuring you maximize your eligibility for financial aid.

Maximizing Financial Aid Benefits

Maximizing your Pell Grant benefits starts by understanding how you can leverage this non-repayable aid effectively. Use the funds toward tuition, fees, and educational expenses. In addition to the Pell Grant, exploring other federal aid and **college scholarships** can complement your funding strategy. Create a comprehensive financial aid plan that aligns your educational goals with available resources, ensuring you fully cover your education costs.

Pell Grant Renewal Process

Once you’ve successfully secured the **Pell Grant funding**, it’s essential to understand the **Pell Grant renewal process**. This involves completing the FAFSA every academic year to continue receiving aid. Be mindful of deadlines and changing eligibility criteria that may affect your renewal status. Keeping track of your academic performance is also crucial, as it may impact your ability to renew your Pell Grant assistance. Regularly check with your school’s **financial aid office** to stay informed about requirements and renewal deadlines.

Financial Aid and Other Grants

While the Pell Grant serves as a cornerstone of **financial aid** for many students, it’s beneficial to explore additional funding avenues. Alternative educational grants exist for students, particularly those with specific needs or identities. Understanding how to find these **grants for low-income students** can enhance your ability to achieve a debt-free education.

Federal and State Financial Aid Programs

The federal government offers numerous financial aid programs beyond the Pell Grant, including the Federal Supplemental Educational Opportunity Grant (FSEOG) and work-study programs. Each of these requires a FAFSA submission to determine eligibility. Many states also provide **state financial aid programs** that complement federal opportunities, so it’s wise to research those available in your location to maximize your education funding.

Applying for Additional Grants and Scholarships

When navigating your options for **educational grants**, don’t forget to research local scholarships and partnerships that your institution might offer. Grants and scholarships can significantly increase your financial support without adding debt, making them valuable tools to aid **college affordability**. Websites and apps dedicated to connecting students with funding sources can streamline your search for available grants, ensuring you make the most out of your funding opportunities.

Key Takeaways

- Understand the **Pell Grant eligibility requirements** to determine your qualification.

- Prepare the necessary documents before starting your **Pell Grant application process** through FAFSA.

- Use online resources effectively to navigate completing the FAFSA and application deadlines.

- Explore additional financial aid options to complement your Pell Grant funding.

FAQ

1. What is a Pell Grant?

A Pell Grant is a form of federal financial aid that provides funding to eligible undergraduate students who demonstrate significant financial need. Unlike loans, Pell Grants do not require repayment, making them a crucial resource for many students aspiring to obtain a college education.

2. How do I check the status of my Pell Grant application?

You can check the status of your Pell Grant application by logging into your FAFSA account or speaking directly with your institution’s financial aid office. These resources provide insights into your application’s progress and any additional actions you may need to take.

3. Can part-time students apply for Pell Grants?

Yes, part-time students are eligible for Pell Grants as long as they meet the **financial aid eligibility** requirements. Their award amount may be adjusted based on their enrollment status compared to full-time students.

4. What documents do I need to renew my Pell Grant?

To renew your Pell Grant, you will need to submit a new FAFSA form along with financial documents that reflect your current income and assets. Keeping these documents organized can simplify the renewal process and ensure continuous funding.

5. Are there any grants for minority students available?

Yes, there are specific **grants for minority students**, including private scholarships and federal aid programs designed to support underrepresented groups. Researching these options can provide additional funding opportunities to enhance your educational journey.

“`